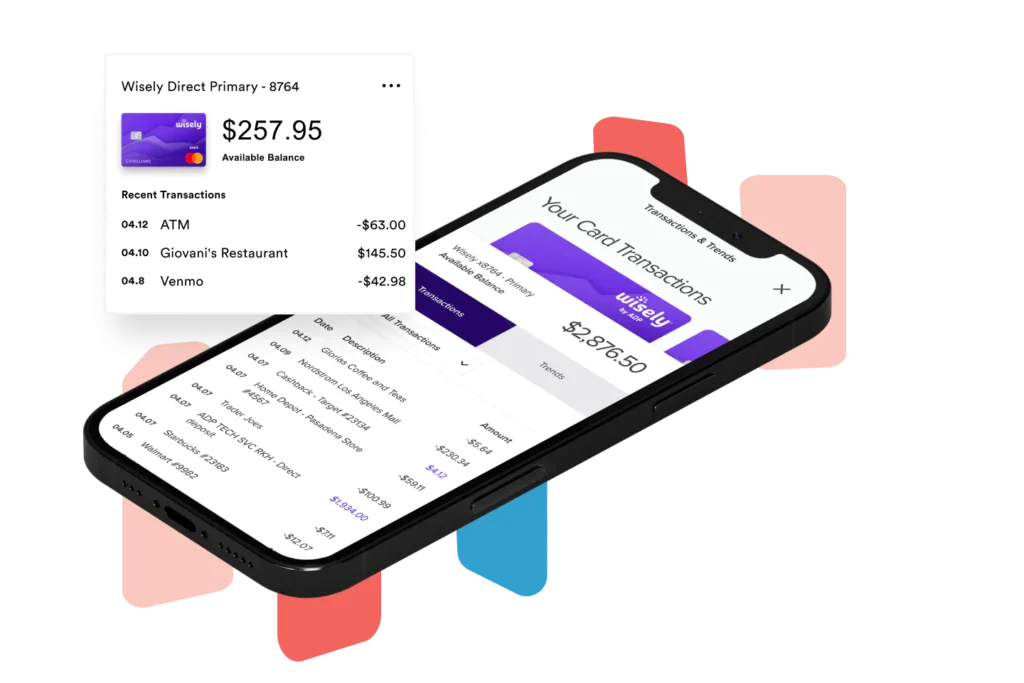

myWisely® by ADP empowers you to take control of your finances, putting you on the path to a brighter financial future. Enroll now to experience a better way to manage your money.

About myWisely®

myWisely® by ADP is dedicated to helping individuals like you achieve financial empowerment. With our innovative solutions, we aim to provide everyone with the tools and resources needed to secure their financial well-being.

What We Do

myWisely® offers a comprehensive suite of services designed to streamline your financial management. With your myWisely card and digital account, you can:

- Access your pay early

- Pay bills conveniently

- Earn cashback rewards on everyday purchases

- Manage your spending, plan effectively, and save money with minimal fees

Our platform provides you with all the necessary tools and support to optimize your financial decisions, ensuring that you get the most out of your money.

Our Legacy

ADP® has been a pioneer in payroll solutions for over 70 years, serving as the trusted payroll provider for millions of workers worldwide. With myWisely, we continue our legacy of innovation by offering fast, flexible, and secure payment solutions tailored to meet the evolving needs of today’s digital landscape.

Create Your myWisely® Account

To begin, you need to create your myWisely® account. Follow these steps:

| Step | Description |

|---|---|

| 1 | Visit the myWisely® website and click on “Get Started.” |

| 2 | Enter your card details and personal information. |

| 3 | Provide your card number, expiration date, and security code. |

| 4 | Enter your social security number and click “Next.” |

Once you’ve entered all the required information, you’ll be able to manage your myWisely® card online.

Connect Your Card

After creating your account, the next step is to connect your card:

- Enter your card details carefully.

- Make sure the expiration date and security code are correct.

- Provide your social security number to verify your identity.

- Click “Next” to complete the process.

Connecting your card allows you to take advantage of all the online management features myWisely® offers.

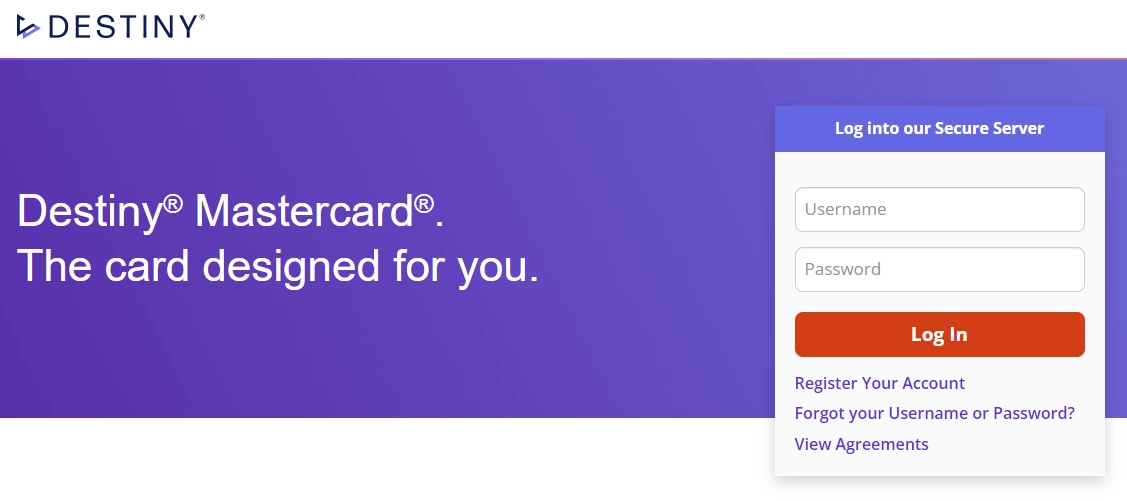

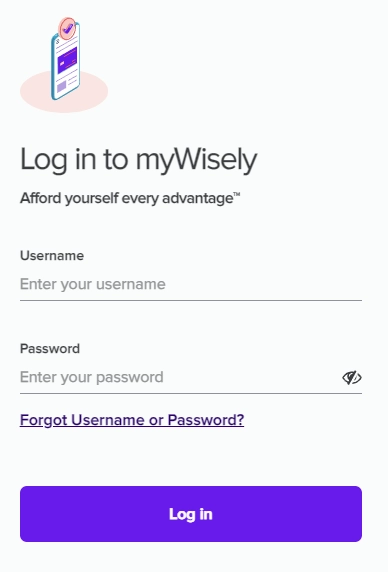

Log In to myWisely

With your account set up, logging in is straightforward:

- Enter your username and password on the myWisely® login page.

- Click “Log in” to access your account.

- If you forget your username or password, don’t worry. There are simple steps to recover them.

Forgot Username or Password?

If you forget your username or password, follow these steps to recover them:

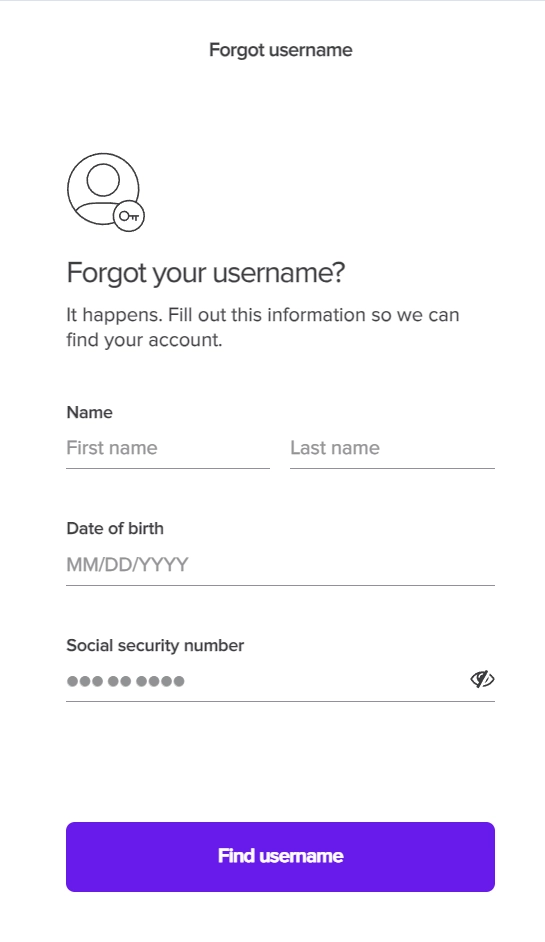

Forgot Username

If you forgot your username, you can easily retrieve it:

- Click on “Forgot username” on the login page.

- Fill out the required information, including your name, date of birth, and social security number.

- Click “Find username” to recover your username.

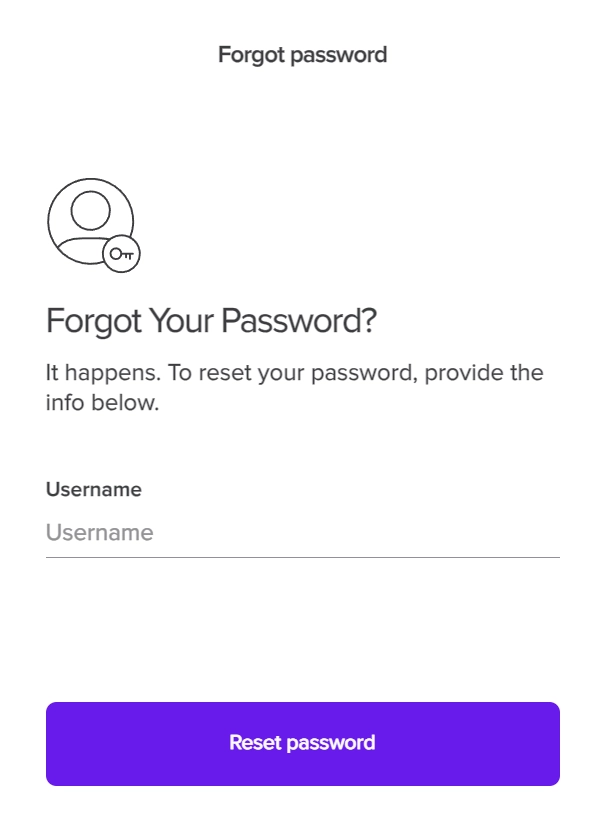

Forgot Password

If you forgot your password, you can reset it easily:

- Click on “Forgot password” on the login page.

- Enter your username to verify your identity.

- Follow the instructions to reset your password and regain access to your account.

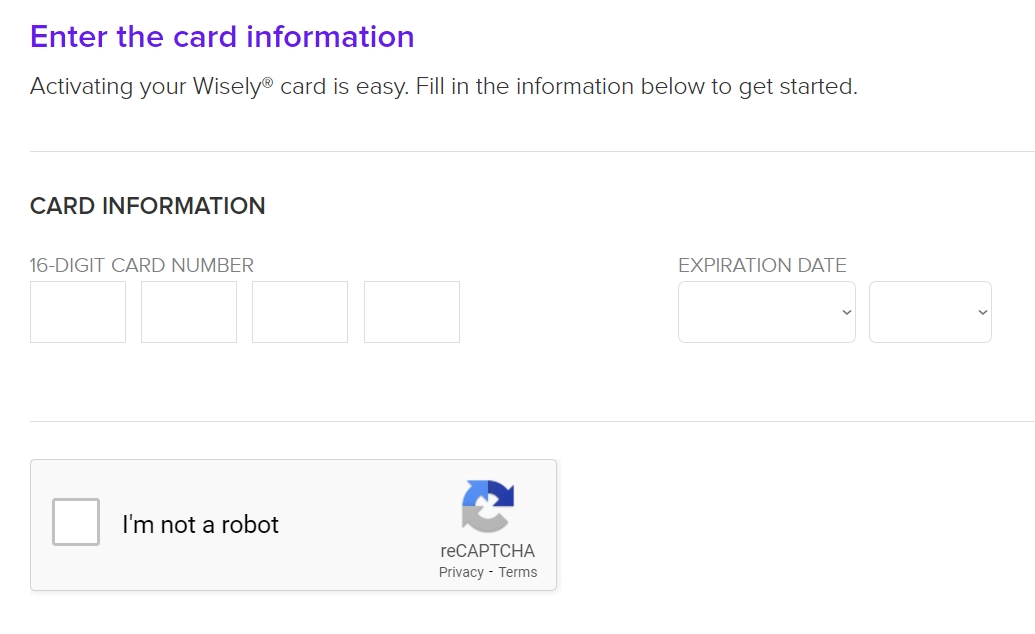

Activate Your myWisely® Card Quickly and Easily

To start using your myWisely® card, visit the official activation site. Enter your card information, including the 16-digit card number and expiration date, and click continue.

Card Information

Activating your myWisely® card is a straightforward process. Begin by entering the 16-digit card number and the expiration date, which you can select from the dropdown menu. The expiration date options range from January to December, and the years span from 2024 to 2034.

Step-by-Step Guide to Activation

| Step | Action |

|---|---|

| 1 | Enter your 16-digit card number. |

| 2 | Select the expiration date. |

| 3 | Click ‘Continue’. |

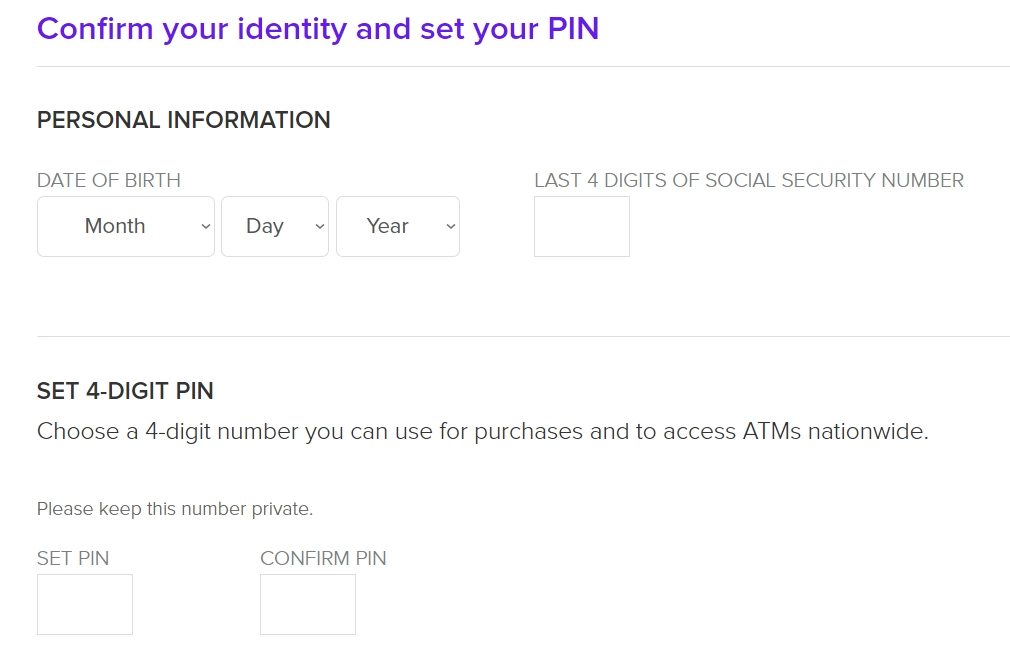

Personal Information

Next, you will need to confirm your identity. Provide your date of birth by selecting the month from the dropdown menu and enter the last four digits of your Social Security number.

Setting Your PIN

Choose a secure 4-digit PIN that you will use for purchases and ATM access. This step is crucial for your card’s security, so pick a number that’s easy to remember but hard for others to guess. After setting your PIN, confirm it by re-entering the number.

| Step | Action |

|---|---|

| 1 | Enter your date of birth and last 4 digits of SSN. |

| 2 | Set a 4-digit PIN and confirm it. |

| 3 | Click ‘Continue’. |

By following these simple steps, your myWisely® card will be activated, and you can start using it immediately for purchases and ATM withdrawals nationwide.

How to Upgrade Your myWisely® Card: Step-by-Step Guide

Why Upgrade?

Upgrading provides access to enhanced features, including additional funding options and increased flexibility in managing your finances. It’s a hassle-free process that empowers you to make the most out of your myWisely prepaid debit card.

Here’s a comprehensive guide to help you through the process.

Requesting a Personalized Card

If you don’t have a Personalized myWisely® Card yet, follow these steps to get one:

| Step | Description |

|---|---|

| 1 | Call myWisely Customer Service at 1-866-313-6901. |

| 2 | Inform the representative that you would like to request a Personalized Card. |

| 3 | Answer a few questions to verify your identity. |

| 4 | A new card will be mailed to your home address, arriving in 7 – 10 business days. |

Making Your Card Portable

Once you have a Personalized Card, you can request Portability to add funds from other sources. Here’s how:

- Call myWisely Customer Service at 1-866-313-6901.

- Inform the representative that you want to make your card Portable.

- Answer a few questions to validate your identity.

- Once validated, you can transfer funds to and from your card using Venmo, PayPal, and other similar apps.

- You can also add income from other sources via direct deposit from a second job, government benefits, or a tax refund.

To attach your card to Venmo, PayPal, and other similar apps, you will need your Account number and Routing Number. Access these by logging into the myWisely® app or online at myWisely.com.

Upgrade to myWisely Pay Director for Premium Benefits

For those seeking an elevated financial experience, myWisely Pay Director offers a premium tier of services. Unlock exclusive advantages such as early paycheck access, automated savings tools, cash-back rewards, and the ability to manage finances for family members. With myWisely Pay Director, you’ll have a powerful financial ally at your fingertips.

Key Features of myWisely Pay Director

- Get Paid Up to 2 Days Early: Say goodbye to the dreaded wait for payday! With myWisely Pay Director, you can access your hard-earned money up to 2 days before your scheduled pay date.

- Direct Deposit Flexibility: Seamlessly receive your tax refunds, government benefits, and income from multiple sources directly into your myWisely Pay account.

- Automated Savings: Effortlessly build your financial safety net by automatically transferring funds into dedicated Savings Envelopes, making it easier to achieve your financial goals.

- Cash Back Rewards: Enjoy exclusive cash-back offers on gift cards and purchases at participating retailers, allowing you to stretch your dollar further.

- Bill Pay: Conveniently manage your bills from the myWisely Pay app, ensuring timely payments and avoiding late fees.

- Family Accounts: Easily manage finances for family members by adding them to your myWisely Pay Director account, fostering financial responsibility and oversight.

- Digital Wallet Integration: Embrace the future of payments by adding your myWisely Pay card to digital wallets like Apple Pay® and Samsung Pay®, for a seamless and secure checkout experience.

myWisely Pay: The Standard for Financial Flexibility

Even without the premium myWisely Pay Director tier, the standard myWisely Pay offering provides a robust set of features that empower you to take control of your finances. With myWisely Pay, you can enjoy benefits such as:

- Employment Portability: Keep your myWisely Pay account even if you change jobs, ensuring uninterrupted financial management.

- Early Paycheck Access: Get access to your earned wages up to 2 days early, eliminating the need to wait for the traditional pay cycle.

- Direct Deposit Options: Seamlessly receive your tax refunds and government benefits directly into your myWisely Pay account.

- Cash Loading: Conveniently add cash to your account at tens of thousands of participating retail locations across the country.

- Mobile Check Deposit: Quickly and securely deposit checks using your smartphone’s camera, eliminating the need for physical trips to the bank.

- Peer-to-Peer Transfers: Easily send and receive funds from popular services like Venmo® and PayPal®, streamlining your financial transactions.

Benefits of Wisely Prepaid Debit Card

Looking to manage your finances efficiently and conveniently? Wisely® prepaid debit card offers a myriad of advantages tailored to meet your financial needs. Say goodbye to hidden fees and hello to early paychecks, cash back rewards, and enhanced security.

Why Choose Wisely?

With no minimum balance requirements or annual fees, Wisely offers financial freedom. Enjoy the convenience of early direct deposit, receiving your paycheck up to 2 days in advance. Say goodbye to hidden fees, overdraft charges, and ATM fees, ensuring every cent you earn is yours to keep.

Furthermore, Wisely provides robust protection against debit card fraud. Transactions are shielded by Visa® or Mastercard® Zero Liability Policy, supplemented with real-time alerts and card-locking features for added security.

Benefits of Wisely Prepaid Debit Card

- Early Direct Deposit: Receive your paycheck up to 2 days in advance, facilitating better money management.

- No Hidden Fees: Bid farewell to minimum balance fees, annual fees, and overdraft charges, ensuring transparent financial transactions.

- Enhanced Security: Shielded transactions, real-time alerts, and card-locking features provide peace of mind against debit card fraud.

- Cash Back Rewards: Earn rewards for everyday purchases, dining, and travel, enhancing your overall financial experience.

- Convenient Budgeting: Schedule payments securely, track payment history, and utilize savings envelopes to achieve your financial goals.

- Easy Fund Management: Access funds at surcharge-free ATMs nationwide, transfer funds to external accounts, and facilitate transactions with Venmo and PayPal.

Furthermore, Wisely is backed by ADP, a reputable payroll processing company with decades of experience, ensuring reliability and trustworthiness.

How to Download & Install myWisely App on Android and iOS

How to Download & Install myWisely App on Android

You can download the myWisely app on your Android device using the instructions below:

- Go to the Google Play Store on your Android device.

- Search for “myWisely” or click on the button below.

- Install the myWisely app on your device.

- Go to your mobile home screen and find the myWisely App.

- Tap on it and enable all the permissions asked by the myWisely App.

Congratulations, you have successfully downloaded and installed the myWisely App on your device. Now you can enjoy all of its features.

Note: If you have downloaded the myWisely app from a third-party source, make sure to enable the unknown source option.

How to Download & Install myWisely App on iOS

Follow these steps to download and install the myWisely app on your iOS device:

- Visit the App Store on your iOS device.

- Tap on the “Search” button on the screen’s right side.

- Search for “myWisely” and press enter.

- Find and download the official myWisely app. You can also download the myWisely app by clicking the button below.

- Authenticate the prompt using Apple Face ID or your Apple password.

- Once the application is installed successfully, launch it to enjoy its features.

myWisely® Customer Service Number

If you need assistance, dial 1-866-313-6901 for Wisely® Member Services. For Wisely Direct customers, call 1-866-313-9029. They’re available 24/7 to help you. You can also visit their website for online support.

Frequently Asked Questions (FAQs)

How do I add money from other sources?

You can direct deposit income from second jobs, tax refunds, or government benefits onto your Wisely by ADP® card. Log in to the myWisely mobile app or mywisely.com, visit your account settings, and tap “Account Numbers” to retrieve your account and routing numbers.

Can my secondary member add any other funds to the card?

No, only the primary member who requested the secondary card can transfer funds to it.

How do I set up Direct Deposit?

Depending on your card type, log into the myWisely app or mywisely.com to retrieve your account and bank routing numbers. Provide these to your HR payroll representative for setup. For Wisely Direct members, follow steps on your ADP employee portal or provide the numbers to your HR department.

What is early direct deposit?

Early direct deposit allows Wisely® cardholders to access funds deposited up to 2 days earlier than the pay date and up to 4 days earlier for government benefits. Opt-in required.

How does early direct deposit work?

After opting in, Wisely processes your employer’s payment instructions and deposits funds accordingly. Typically, you’ll receive pay up to 2 days early, but this may vary based on payment timing.

Is there a fee to get early direct deposit?

No, there’s no cost associated with early direct deposit.

If I already have direct deposit set up, do I need to opt in to get paid early?

Yes, opt-in is necessary for early direct deposit, even if you already have direct deposit set up. Simply log in to your account and enable early direct deposit.

Does my employer need to use ADP for payroll for me to get early direct deposit?

No, your employer’s payroll provider doesn’t affect your eligibility for early direct deposit.

Why didn’t I get my early direct deposit the same day I usually receive it?

Factors like delayed payroll submissions or processing times can impact the timing of early direct deposit. While most receive funds early, there may be occasional delays.

Do bank holidays affect how I get paid?

Yes, bank holidays can influence payday timing. Payments may be processed before or after the holiday, depending on when payment instructions are received.

How do I find my Wisely® account and routing information?

Access your Wisely account and routing numbers in the myWisely app or online at mywisely.com under your account settings.

How do I load a check with my mobile device?

Use Ingo® Money in the myWisely app to load checks by snapping a photo and following prompts. Approval times vary, and users must be 18 or older.

How do I add cash to my card?

You have two options: Use Green Dot® to deposit cash at retailers nationwide or visit Western Union. Both methods incur fees and have deposit limits.

How do I know which card I have?

Check the back of your card for identification. Depending on the type, follow specific steps to set up features like early direct deposit.

How do I get paid up to 2 days early with direct deposit?

Make sure your card is activated, set up direct deposit, and opt-in through the myWisely app or website. Early access is available for eligible cardholders.

How do I add money to a secondary card?

Only the primary cardholder can transfer funds to the secondary card. Log into the myWisely app or website, navigate to Move Money, and follow instructions for transferring funds.

How do I activate my card?

To activate your card, use the myWisely® app or visit mywisely.com. Alternatively, call Wisely Pay at 1-866-313-6901 or Wisely Direct at 1-866-313-9029. Remember not to use personal information as your PIN.

Is there a fee to set up my Savings Envelope?

No, setting up your Savings Envelope incurs no fee. Start saving without additional charges.

How long will it take to get my personalized card in the mail?

Your personalized card should arrive within 7-10 business days after enrollment. Contact 1-866-313-9029 for Wisely Direct or 1-866-313-6901 for Wisely Pay if not received.

How do I receive my pay directly onto my card?

For Wisely Direct, visit your employer portal or contact HR for direct deposit enrollment. Provide your Wisely card’s routing and account numbers. Download the myWisely app to find these details.

How do I add funds to my Savings Envelope and start saving money?

Login to the myWisely® app or mywisely.com, tap on Savings, then Add Money. Specify the amount you want to save. Transferred funds will not affect your available balance.

What are the benefits of upgrading my card?

Upgraded members enjoy premium features like direct deposit from additional sources and early pay access. Learn more about the advantages of upgrading your card.

Can I automate my savings?

Absolutely! In the myWisely app or myWisely.com, set up automatic transfers monthly or per paycheck. Adjust or disable this feature anytime.

How can I upgrade my card?

Click to upgrade NOW to access premium features and additional benefits for Wisely Pay.

Where can I get the myWisely® app?

Download the myWisely app from Apple® or Google Play™ store. Manage your account conveniently, anytime, anywhere.

Is the Savings Envelope a savings account? Does it earn interest?

The Savings Envelope is part of your Wisely account and doesn’t earn interest. It’s a tool for managing your finances efficiently.

What if I don’t know the new card member’s Social Security Number?

You must have this information to request a Wisely® card for them.

How do I know if I have a Wisely Direct or Wisely Pay card?

Check the back of your card for the card type details in the small print on the lower half.

As a secondary cardholder, can I set up my Savings Envelope?

No, only primary cardholders can utilize the Savings Envelope feature in the myWisely® app.

How does a secondary member activate their card?

Secondary members can activate their card and set a PIN using the myWisely app or by visiting mywisely.com. Alternatively, they can call Wisely Pay at 1-866-313-6901 or Wisely Direct at 1-866-313-9029.

Are there fees for using my card?

No overdraft fees are charged. However, inactivity fees apply after a period. Refer to the Wisely List of All Fees for details.

How do I know which card I have?

Check your card type using the details provided on the back of your card.

What if I don’t know the new card member’s Social Security Number?

You need this information to request a Wisely® card for them.

How do I know which card I have?

Check your card type using the details provided on the back of your card.

Is there a limit to how much can be added to my Savings Envelope?

Your Savings Envelope is limited to your Wisely® account’s total limit. Check your cardholder agreement for specifics.

What are the benefits of upgrading my card?

Discover premium features and additional benefits by upgrading your Wisely Pay card.

Can I automate my savings?

Yes, use the myWisely app or myWisely.com to set up automatic transfers per paycheck or monthly.

How do I receive my pay directly onto my card?

Enroll in direct deposit through your employer portal or contact HR. Provide your Wisely card’s routing and account numbers.

How can I add funds to my Savings Envelope and start saving money?

Access the myWisely® app or mywisely.com, go to Savings, then Add Money. Specify the amount you want to save.

What if I don’t know the new card member’s Social Security Number?

You’ll need this information to request a Wisely® card for them.

How long will it take to get my personalized card in the mail?

Expect your personalized card within 7-10 business days after enrollment. Contact 1-866-313-9029 for Wisely Direct or 1-866-313-6901 for Wisely Pay if not received.

Where can I get the myWisely® app?

Download the myWisely app from Apple® or Google Play™ store to manage your account on the go.

How do I activate my card?

Activate your card via the myWisely® app, mywisely.com, or by calling the provided numbers. Remember not to use personal information as your PIN.

How can I add funds to my Savings Envelope and start saving money?

Access the myWisely® app or mywisely.com, navigate to Savings, then Add Money. Specify the desired amount to save.

Is there a fee to set up my Savings Envelope?

No, setting up your Savings Envelope incurs no fee. Start saving without additional charges.

How do I know if I have a Wisely Direct or Wisely Pay card?

Check the back of your card for the card type details in the small print on the lower half.

What are the benefits of upgrading my card?

Enjoy premium features and additional benefits by upgrading your Wisely Pay card.

Can I automate my savings?

Absolutely! Use the myWisely app or myWisely.com to set up automatic transfers per paycheck or monthly.

Can I send money to family and friends?

Absolutely. You can link your card to all your favorite peer-to-peer apps like Venmo®. Alternatively, purchase a MoneyPak® at a nearby retailer, follow simple steps, and send cash instantly. Participating retailers include 7-11, CVS, Dollar General, and more.

How do I pay bills using the myWisely® app?

Paying bills using the myWisely® app allows quick initiation of bill payments with your smartphone. Log in, tap ‘Move Money’, select ‘Pay a Bill’, and snap a photo of your bill or add a new biller. Payments are deducted from your Wisely balance.

What transactions are not allowed on the card?

The Wisely® card cannot be used for unlawful Internet gambling or any illegal transaction.

How do I use my card to pay for recurring monthly payments (such as mobile phone)?

Contact your biller/retailer for direct bill payment options. If accepted, enter your card details into the recurring billing payments form.

Can my card be used to make debit or credit transactions?

Your Wisely® card can be used for both debit and credit transactions. Debit transactions require a PIN and are ideal for cash back, while credit transactions do not require a PIN and do not incur fees.

Is there a fee for paying bills using the myWisely app?

No, Wisely does not charge a fee for paying bills using the myWisely app. However, standard data charges may apply. Refer to your Wisely Cardholder Agreement for details.

How is my bill paid using a photo or an image of my bill?

Your bill information is securely extracted from the photo or image uploaded in the myWisely app and processed electronically for payment. If electronic payment is not possible, a check will be mailed to the biller.

Can I get cash using my card?

Access cash through ATMs worldwide or get cash back from participating merchants. You can also withdraw from banks with your PIN. Refer to your Cardholder Agreement for details on fees and limits.

What if I don’t have a photo or an image of my bill?

You can still pay bills within the myWisely® app by searching for the biller or adding a new one. The payment amount will be deducted from your Wisely balance.

Does Wisely® offer EMV chip cards?

Yes, Wisely® offers EMV (chip) cards. Upgraded cardholders can get the new EMV cards. Wisely Direct cards already come with EMV chips.

How do I know if my bill payment was sent electronically or by check?

You will receive a confirmation email when your bill has been delivered to the payee that includes the payment method. You can also view the payment method on the bill details screen within the bill pay section of the myWisely® app.

Can I schedule a bill payment?

Yes, you can. First, select the date you want to make the payment by clicking on the “schedule for” date. You will receive a notification the day before the payment. On the scheduled day, your payment will be sent securely.

What is the processing time for bill payments?

Electronic payments are typically delivered to the biller within 48 hours after the submission of the bill in the myWisely app. Check payments usually take 5-7 business days for delivery.

Can I set up a recurring bill payment?

Unfortunately, recurring payments cannot be set up at this time.

How do I cancel a bill payment?

Bills can be cancelled from the bill details page within the myWisely® app. If the payment has already been sent out, contact Wisely customer service to inquire about a stop payment request.

What do I do if my bill payment was not received?

If your payment is not credited in a reasonable time, contact Wisely customer service for assistance with further payment investigation.

Can I use my Wisely® Card with Apple Pay®, Samsung Pay®, Google Pay™?

Yes, Wisely cards can be added to mobile wallets for use at participating stores, online, and on apps that accept Apple Pay®, Samsung Pay®, and Google Pay™.

How can I confirm my bill payment was sent?

You will receive a confirmation email when your bill has been delivered to the payee. Additionally, you can view the status of your bill in the bill details page within the myWisely® app.

How do I know which card I have?

You can identify your Wisely® Card by logging into the myWisely app

What if I didn’t authorize the bill payment?

Contact Wisely customer service for assistance with payment investigation.

Can I use my Wisely® Card once it has been added to my digital wallet?

Yes, simply use your mobile wallet at participating stores, online, and on apps that accept Apple Pay®, Samsung Pay®, or Google Pay™.

Can I use multiple devices for Apple Pay®, Samsung Pay®, Google Pay™ with my Wisely® Card?

Yes, you can add your Wisely card to multiple mobile wallets on multiple devices.

If I have a secondary card for my spouse, can they also enroll in Apple Pay®, Samsung Pay®, Google Pay™?

Yes, they can add their Wisely® card to their mobile wallet.

Can a secondary card be used outside of the U.S. for purchases?

Yes, the Wisely® card can be used internationally wherever Visa® Debit or debit MasterCard® are accepted. Secondary members must set a travel notice in the myWisely app.

Can I request a card for a spouse or family member?

Yes, as the primary Wisely® member, you can request up to 3 cards for your spouse or family members. Secondary cards function like Visa® Debit or MasterCard® for various transactions, reducing the need for cash.

How do I change or update my personal information?

Updating personal details like email, address, or phone number is easy through the myWisely® app or mywisely.com. Navigate to Account Settings and tap Profile Info to make necessary changes.

What if I forgot my PIN?

If you forget your PIN or want to change it, contact Cardholder Services via the number on your card’s back for assistance.

What happens if my card is expiring or expired?

An updated card is automatically sent nearing the expiration date. If you haven’t received it before the expiry, contact us at 1-866-313-6901. Wisely Direct customers call 1-866-313-9029.

How do I check my balance and view transaction history without a fee?

Access your balance, transaction history, nearby ATMs, and set alerts through the myWisely app or myWisely.com. Customize alerts, including low balance notifications, as per your preferences.

How can I change my PIN number?

Change your PIN conveniently through the myWisely® app. Navigate to card settings and follow the prompts to set a new PIN.

What if I forgot my User ID or Password?

Retrieve your username and password either through our website or the myWisely® app for seamless access.

How do I reach the Wisely® support team?

For any queries or assistance, contact Wisely® Member Services at 1-866-313-6901. We’re available 24/7 to address your concerns.

Can I take this card with me if I change jobs?

Absolutely. Wisely card facilitates direct deposit from various income sources, including secondary jobs, irrespective of your employer.

What are pending transactions?

Pending transactions refer to the money earmarked for purchases made with your card but not yet collected by the merchant.

How do I know which card I have?

Identify your card type by referring to the back of your card.

How do I opt into Dosh?

To opt into Dosh, access the myWisely app or log in to your account on mywisely.com. Navigate to “Wisely Rewards” in the left-hand menu, select “Cash back purchases,” and click “opt-in” to agree to terms.

What is the difference between an eGift card and other gift cards?

An eGift card, unlike traditional gift cards, is designed to provide cash back into your myWisely Rewards Savings Envelope. It’s electronic, purchased and delivered directly through the myWisely app for personal use only.

How do I use myWisely to see which merchants offer cash back?

To discover merchants offering cash back through myWisely, access “Wisely Rewards” in the main menu, select “Cash Back – Purchases,” and opt into the program if not done previously. Then, explore eligible cash back offers within the Dosh experience.

Can I redeem my eGift cards for cash?

eGift cards are intended for purchasing goods and merchandise only. Refer to the specific terms and conditions on each card product’s page prior to purchase for details on redemption.

Where did my rewards go?

Your rewards are deposited into your Savings Envelope and do not reflect in your available balance. To transfer funds from your Savings Envelope to your available balance, access the “future” section of the myWisely app, click withdraw, and specify the amount.

How will my eGift card be delivered? How soon will I receive it?

Upon completing your purchase, your eGift card will be instantly available in your Wisely digital wallet for immediate use.

If I return my purchase, will I lose my rewards?

No, once your cash back is deposited into your Savings Envelope, it remains unaffected even if you return a purchase.

Do I need to download the Dosh app?

No, linking your Wisely card to Dosh is solely done through the myWisely app; downloading the Dosh app is unnecessary.

How can I redeem my eGift card?

To redeem your eGift card, access the myWisely app, navigate to Wisely Rewards, select “Cash Back – eGift Cards,” and choose the “Wallet” tab. Present the bar code in person or enter the eGift card number online during checkout.

Is there a limit to the number of eGift cards I can purchase?

No, there is no limit to the number of eGift cards you can purchase via the myWisely app. However, refer to the preset denominations and specific terms on each card product’s page before purchasing.

Can I opt out of receiving an email confirmation after each purchase?

No, email confirmations after each purchase are mandatory and cannot be opted out of by cardholders.

How will I know when I receive cash back?

Monitor your transaction history to track when Cash back Rewards have been loaded into your account. You can also set up alerts in the myWisely app to receive notifications when cash back is deposited into your Savings Envelope.

Who should I reach out to if I am experiencing issues with Dosh?

If you encounter any problems with the Dosh service, contact the support number located on the back of your card for assistance.

How do I purchase an eGift card on the myWisely app?

Log in to the myWisely app, select “Wisely Cash Back Rewards,” choose “Cash back eGift Cards,” pick a participating retailer, and complete your purchase directly within the app. Ensure you have sufficient funds in your account.

Can I use my Wisely card with the Dosh app?

No, Wisely cardholders must utilize the myWisely app exclusively. The Dosh app will direct you to myWisely to link your Wisely card.

What’s the difference between Dosh on the myWisely app and the Dosh app?

The Dosh service is fully integrated into the myWisely app and offers identical cash back benefits as the standalone Dosh app. Ensure you opt-in for Dosh on myWisely to enjoy cash back rewards with your Wisely card.

Can I opt out of Dosh?

Yes, you can opt out of Dosh by contacting the support number on the back of your card and requesting assistance from an agent.

Will my eGift card expire?

Please refer to the specific terms and conditions found on each card product’s page prior to purchase.

How much cash back do I get when I purchase an eGift card?

Cash Back Rewards typically range between 2% and 10% of the eGift card amount purchased. The cash back amount is predetermined and will be indicated prior to purchasing the eGift card.

When do I receive my Cash Back Rewards?

You’ll receive your Cash Back Reward immediately after you purchase your eGift card.

When I earn cash back rewards, where do my rewards go?

Your rewards will appear in your Wisely Rewards Savings Envelope and will not appear in your available balance. To move your funds to your available balance, log into the myWisely app, tap Savings, click Withdraw, and enter the amount to move.

How can I withdraw the cash back reward from my Wisely Rewards Savings Envelope?

To transfer funds from your Wisely Rewards Savings Envelope to your primary card account, log into the myWisely app or mywisely.com, tap Savings at the bottom, click Withdraw, and enter the amount to transfer to your primary card account.

Will I receive my Cash Back Reward for every eGift card purchase?

Cash Back Rewards apply to all eGift cards available for purchase through the myWisely app in the amount stated.

Do I get cash back if I purchase a gift card at a store or restaurant with my Wisely card?

Cash Back Rewards apply only to eGift cards purchased through the myWisely app.

What should I do if my card is lost, stolen, or used without my permission?

If your card is lost or stolen, lock it instantly using the myWisely® app or mywisely.com. Contact the call center immediately at 1-866-313-6901. We’ll cancel your card and transfer funds to a new card, which will be sent to you. Funds transfer upon new card activation.

How much does it cost to replace a lost, stolen, or damaged card?

We provide one free replacement for a lost or stolen card per calendar year. Additional replacements within the same year will incur a fee. Refer to the Cardholder Agreement for more details.

Can you tell me more about additional fraud protection?

Qualifying transactions are protected by the VISA® or Mastercard® Zero Liability Policy, providing protection from unauthorized purchases. Additional protections may apply under Federal Regulation E. Check the Cardholder Agreement on the myWisely® app or mywisely.com for more details.

What do I do if I have a question or think there is an error with a transaction on my card?

Contact Wisely® Member Services at 1-866-313-6901 for assistance. If you suspect fraud, lock your card using the myWisely® app. You can unlock it if found, but report a lost or stolen card immediately.

How do I dispute a transaction and how long does it take to resolve?

Contact Wisely® Member Services at 1-866-313-6901 if you notice unauthorized charges. We will review your transaction history and provide assistance. Resolution timeframes vary based on the transaction type.

Will Wisely® freeze my funds while a dispute is being resolved?

Wisely® does not freeze funds during disputes. If you detect unauthorized activity, request a new card. The current card becomes invalid, and a new one may take up to 10 business days to arrive. Expedited delivery is available for an additional fee.

What is a travel notice?

A travel notice is a security measure that protects against fraud when using your Wisely by ADP® card outside your home state and bordering states. Set a travel notice to avoid declines during travel.

How do travel notices help protect me from fraud?

Travel notices reduce the risk of out-of-state and international fraud by notifying the card issuer of your travel plans.

How can I set a travel notice and how long does it take?

Set a travel notice on the myWisely® app or myWisely.com. It becomes effective immediately upon saving changes. You can also call cardholder services at 1-866-313-6901.

What happens if I forget to set a travel notice?

Your card may be declined if you travel outside your home state and bordering states without setting a travel notice.

What should I do if my card is declined when traveling?

Set up a travel notice on the myWisely® app or myWisely.com, or call cardholder services at 1-866-313-6901 to avoid declines while traveling.

Is a fee charged if my card is declined?

There is no fee if your card is declined when attempting a purchase.

What do I do if I misplace or lose my card?

Lock your card immediately using the myWisely® app. If you find it, unlock and resume using it. If not, contact cardholder services at 1-866-313-6901 to order a replacement card.

Why would I want to lock or unlock my card?

Locking your card adds security, preventing its use. Unlock it when you need to use it again. Manage this feature through the myWisely® app or myWisely.com.

Is the money on my Wisely card FDIC insured?

Upon activation, your card balance is FDIC insured up to the eligible amount through Fifth Third Bank, N.A., or Pathward®, N.A. Refer to your cardholder agreement on the myWisely app or mywisely.com for more information.

Can I have my tax refund added to my Wisely card?

Yes, if you have a Wisely Direct or an upgraded Wisely Pay card (check the back of your card to determine the type). An upgrade is required for non-upgraded Wisely Pay cards. After your tax return is processed by the IRS, your refund will be added to your Wisely card.

Why should I have my tax refund direct deposited to my Wisely card?

Direct deposit of your tax refund means quick access to funds for saving, paying bills, and earning cash back rewards at participating merchants. This method provides a fast and secure way to access your refund.

What do I have to do before setting up a direct deposit for my tax refund?

First, activate your Wisely card at the provided link or in the myWisely app. Then, get your routing and account numbers by downloading the myWisely app or logging into mywisely.com. This information is necessary to set up the direct deposit.

How do I direct deposit my tax refund to my Wisely card?

To direct deposit your tax refund to your Wisely card, log in to get your Wisely account and routing numbers. Enter these in the refund section of your tax return, select checking as your refund type, and set up account alerts in the myWisely app to know when your refund arrives.

How do I set up an alert to get notified when my tax refund is posted to my account?

Log into the myWisely app or mywisely.com to set up alerts for notifications when your tax refund arrives. You can also check your balance, view transaction history, find nearby ATMs, and see spending trends using these platforms.

What is the status of my tax refund and how can I check?

Your tax refund will be added to your Wisely card once your return is processed and completed by the IRS. To check the status, visit the IRS website, which updates information every 24 hours. Customer care does not have details on the exact arrival of your refund.

How can I use my tax refund added to my Wisely card?

Once your refund is added to your Wisely card, use it for everyday purchases in stores, online, or over the phone where Visa debit cards or Debit Mastercards are accepted. You can also add your Wisely card to your mobile wallet for easy payments via Apple Pay, Samsung Pay, or Google Pay.

Can I save part of my tax refund for future bills or a special occasion?

Yes, you can easily save part of your tax refund. After your refund is added to your card, log into the myWisely mobile app or mywisely.com, tap or click “Future,” and start saving for future expenses or special occasions.