Are you tired of traditional banking fees and lackluster rewards? IndigoCard is here to change the game. With up to 4% cash back on everyday purchases and a user-friendly mobile app, IndigoCard offers a fresh approach to managing your money. In this comprehensive guide, we’ll explore how IndigoCard is revolutionizing the way you bank, spend, and earn rewards.

About MyIndigoCard?

IndigoCard is a fintech platform that launched in 2019, offering a feature-rich debit card paired with a modern mobile banking experience. Founded by a team of fintech veterans, IndigoCard aims to reimagine checking accounts and rewards programs for the digital age.

At its core, IndigoCard operates as a digital-only checking account with the added convenience of a debit card for purchases and withdrawals. What sets it apart is the robust mobile app that allows you to manage every aspect of your account, from opening it to tracking transactions.

IndigoCard Features

- FDIC-insured account: Your money is safe and secure.

- Access to over 55,000 fee-free ATMs nationwide: Cash when you need it, without the fees.

- Up to 4% cash back rewards on eligible purchases: Earn as you spend on everyday items.

- Digital account management via mobile app: Control your finances from your smartphone.

- Budgeting tools and spending insights: Understand where your money goes.

- Instant mobile check deposit: No more trips to the bank.

- 24/7 support and dispute resolution: Help is always available.

IndigoCard Benefits

Activating your Indigo Credit Card offers numerous benefits and vital information:

- Building Credit: Your payments are reported to major credit bureaus, aiding in credit score improvement.

- Pre Qualification: Perform a soft check pre-qualification without impacting your credit score.

- Fees and Costs: Annual fee ranges from $0 to $99 based on your credit profile. No security deposit is required, but be aware of the 29.99% APR and lack of rewards.

- Credit Limit and Usage: Starts with a $300 limit, emphasizing low credit utilization.

- Customer Service and Support: A support hotline is available for inquiries, and payments can be made via debit cards.

The Impact of IndigoCard on Your Credit Score

Now, let’s talk about why the IndigoCard is more than just a convenient payment tool. It’s a powerful ally in your journey to better credit. By using your IndigoCard responsibly – making on-time payments, keeping your balance low, and avoiding unnecessary charges – you’re sending positive signals to credit bureaus.

Over time, this responsible behavior can help boost your credit score. A higher credit score opens doors to better financial products, lower interest rates, and even job opportunities. It’s like a financial passport that gets you access to better deals and opportunities.

| Credit Score Range | Classification | Impact on Financial Opportunities |

|---|---|---|

| 300-579 | Poor | Limited access to credit, high interest rates |

| 580-669 | Fair | More options, but still high interest rates |

| 670-739 | Good | Lower interest rates, more credit options |

| 740-799 | Very Good | Most credit options, very competitive rates |

| 800-850 | Excellent | Best rates, highest credit limits |

Apply To IndigoCard

Applying for the Indigo Mastercard® is simple and straightforward. With just a few easy steps, you can unlock the benefits of a card that reports to all three credit bureaus, giving you the opportunity to build or rebuild your credit history. Plus, with Mastercard accepted at over 40 million locations worldwide, you’ll have the flexibility to shop online, in-app, and in-store with ease.

Eligibility Requirements

To qualify for an IndigoCard account, you must:

- Be 18 years or older

- Have a valid Social Security Number

- Be a US citizen or permanent resident

- Pass identity verification checks

- Have a US address and US bank account

Note that joint or teen accounts are not available yet, nor are business accounts, though the latter is on the roadmap.

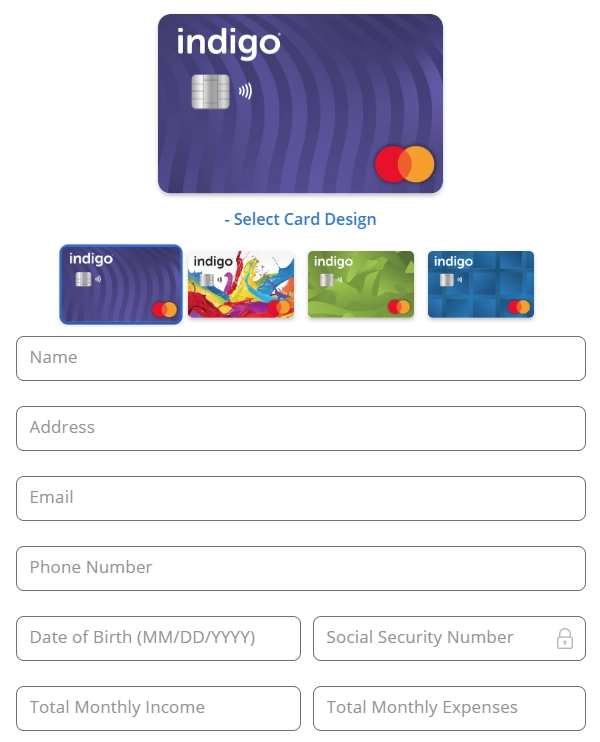

Step-by-Step Application Process

Applying for the Indigo Mastercard® is as easy as filling out a simple online form. Just visit the Indigocard application page and complete the following fields:

| Name | Your full name |

| Address | Your current mailing address |

| Your email address | |

| Phone Number | Your contact number |

| Date of Birth | Your date of birth (MM/DD/YYYY) |

| Social Security Number | Your SSN for verification purposes |

| Total Monthly Income | Your total monthly earnings |

| Total Monthly Expenses | Your total monthly expenditures |

Once approved, you can start using your virtual card immediately while your physical card is shipped.

Funding Your IndigoCard

Initial Deposit

Start with at least $20, but be aware that some new accounts may require $200-$500. The app will clearly display your funding requirements.

Recurring Direct Deposits

Set up paycheck or government benefits direct deposit for automatic funding. Even better, IndigoCard offers early direct deposit access, landing your money 2 days early.

Bank Transfers

Transfer money from external accounts as needed. Set up recurring transfers or manually push funds anytime.

Mobile Check Deposits

Deposit checks instantly by taking photos through the app. Limits are up to $5,000 per check with an $8,000 monthly limit.

Adding Cash

While direct cash deposits aren’t available, you can add cash through partner retailers like Walgreens for a small fee.

Using Your IndigoCard

In-Store Purchases

- Swipe Card: Use the magnetic stripe and enter your PIN.

- Insert Chip: Use EMV chip readers for enhanced security.

- Contactless Payments: Use Apple Pay, Google Pay, or Samsung Pay.

- Cash Back: Get instant cash back at checkout without fees.

Online Purchases

- Saved Payment Methods: Enable 1-click ordering on frequent sites.

- Virtual Card Numbers: Use temporary numbers for extra security.

- Mobile Wallets: Use for in-app and contactless payments.

Bill Pay

Set up autopay or make manual payments for rent, utilities, and more. With smart planning, all your monthly bills can be handled via IndigoCard.

ATM Withdrawals

Access over 55,000 fee-free ATMs in the MoneyPass network. Use the app to find nearby ATMs and check your balance before withdrawing.

International Use

Enable international transactions in-app for global ATM and purchase access. Be aware of the 3% foreign transaction fee.

Managing Your IndigoCard

The Mobile App

- View Transactions: See pending and posted purchases in real-time.

- Check Balance: Always know your current balance.

- Freeze/Unfreeze Card: Instantly block your card if lost or stolen.

- Change PIN: Update your 4-digit PIN anytime.

- Report Fraud: Dispute charges and request replacements in-app.

Account Security

- Biometric Login: Use fingerprint or face scan for quick, secure access.

- AI Monitoring: Advanced algorithms detect potential fraud.

- Customizable Alerts: Get real-time notifications for various activities.

Card Upgrades

Over time, you may qualify for premium metal cards like IndigoCard Pro and IndigoCard Black, offering higher rewards and exclusive perks.

Cash Back & Rewards

How It Works

- Cash Back Categories:

- 4% at gas stations

- 3% at restaurants

- 2% at grocery stores

- 1% on general purchases

- Earning Rates: Base rate is 1% up to $15,000 annually, then 0.5%. Pro and Black cards offer higher rates.

- Reward Rules: Points accrue daily and can be redeemed anytime.

Maximizing Cash Back

- Track Categories: Focus on highest reward categories each month.

- Mind the Caps: Spread purchases to optimize earnings.

- Targeted Offers: Take advantage of limited-time boosted offers.

Redeeming Rewards

- Auto-Redeem: Deposit rewards automatically when thresholds are met.

- Statement Credits: Offset past purchases.

- Gift Cards: Convert points to instant digital gift cards.

- No Minimums: Redeem even small balances.

Status Levels: Rewards for Loyalty

- Requirements: Based on annual transactions and spend. Premium and Elite need $15,000+ yearly.

- Perks: Higher status means better rewards, dedicated support, and card upgrades.

Cardholder Perks

Depending on your card level, enjoy perks like:

- Roadside Assistance: 24/7 help for car troubles.

- Travel Insurance: Trip cancellation, delay protection, and baggage coverage.

- Purchase Protection: Extended warranties and reimbursement for stolen items.

Upgrading Your Card

Premium Card Options

- IndigoCard Pro:

- 5% on travel

- 3% on restaurants

- 2% on groceries

- 1% general spending

- $195 annual fee

- IndigoCard Black:

- 7% on travel

- 4% on dining

- 3% on groceries

- 2% general spending

- $295 annual fee

Added Features

- Airport Lounge Access: Free entry to 1,200+ lounges with Priority Pass Select.

- Higher Cash Back: Up to 7% back vs. 4% on the basic card.

- Travel Credit: $100 annual credit on IndigoCard Black.

Premium Perks

- Concierge Service: 24/7 help for travel, dining, events, and more.

- Free ATM Withdrawals: Higher limits and no out-of-network fees.

- Gift Cards: Annual gifts like $50 for streaming services.

Pros and Cons of IndigoCard

Advantages

- Cash Back Rewards: Up to 4% back is generous for a debit card.

- Modern App Features: Robust tools for digital money management.

- Premium Card Offerings: Metal cards rival premium credit cards.

Disadvantages

- No Joint Accounts: Each person must apply separately.

- Limited Customer Service: No in-person branch visits.

- Credit Check: Soft pull could slightly impact scores.

Best Suited For

- Tech-Savvy Users: Those comfortable with all-digital banking will find IndigoCard’s app intuitive and convenient.

- Online Shoppers: With bonus rewards on e-commerce, IndigoCard is a lucrative choice for those who frequently shop online.

- Established Credit Holders: Since approval requires a good credit profile, IndigoCard is best for those with existing credit history.

- Fee-Conscious Consumers: Those tired of traditional bank fees will appreciate IndigoCard’s transparent, no-fee structure.

- Reward Maximizers: Strategic spenders can earn substantial cash back by optimizing purchases across bonus categories.

MyIndigoCard ❤️【Login Account & Register】

Are you looking for an effective way to manage your finances and improve your credit score? Look no further than the Indigo Credit Card. In this comprehensive guide, I’ll walk you through everything you need to know about accessing and managing your IndigoCard account, from logging in to resetting your credentials. Let’s dive in!

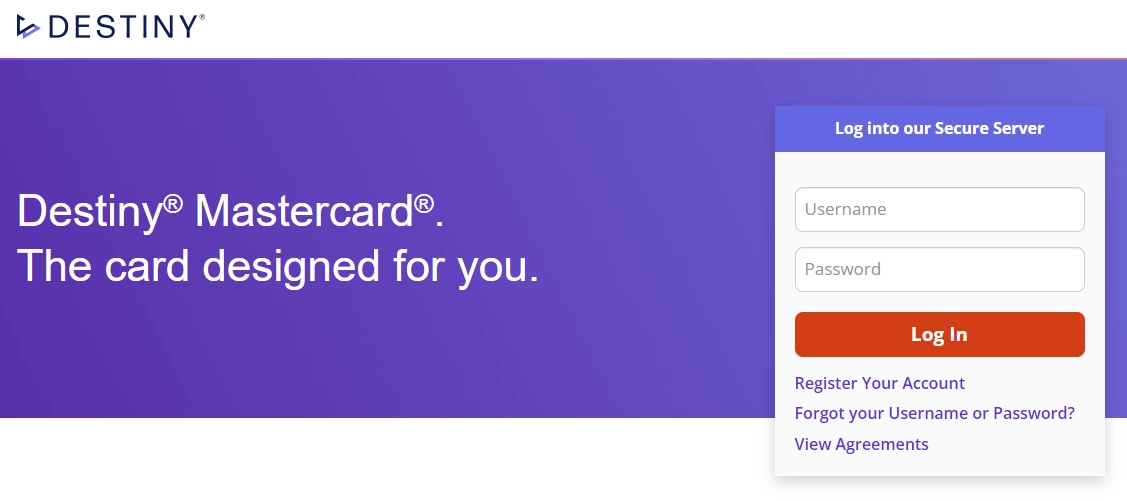

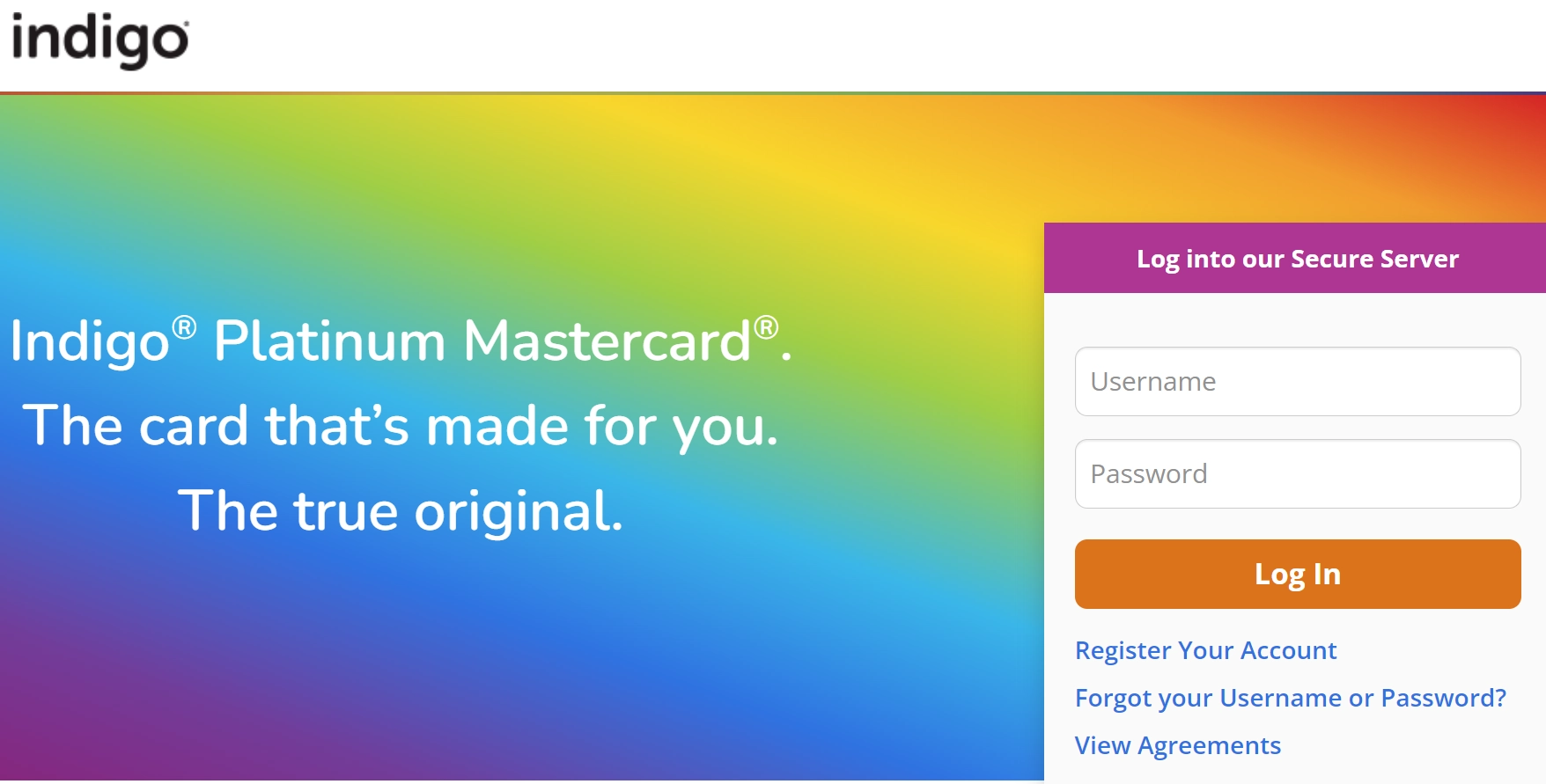

Navigating the IndigoCard Login Process

To harness the full potential of your Indigo Credit Card, you first need to access your account. Here’s a step-by-step guide to help you log in:

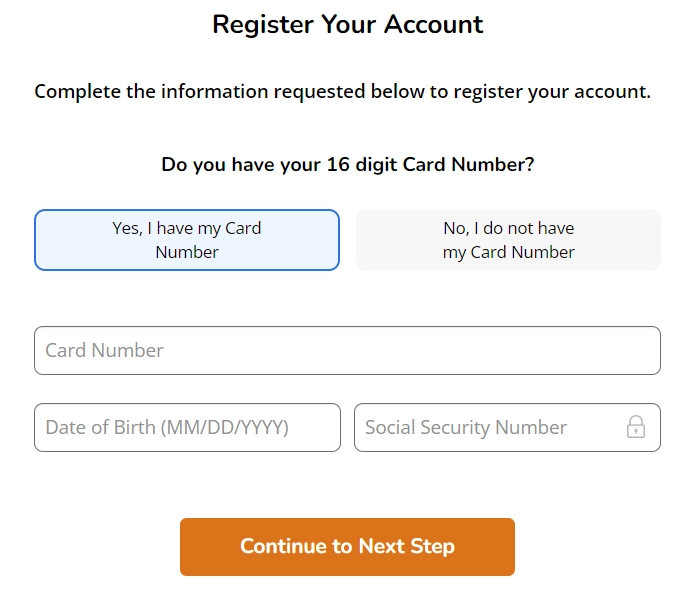

Step 1: Register Your Account

- Visit the official IndigoCard website at www.indigocard.com.

- Look for the “Register Your Account” section and click on it.

- Follow the on-screen instructions to set up your login details.

Step 2: Logging In

- Once you’ve registered, return to the IndigoCard website.

- Enter your username and password in the designated fields.

- For added security, you’ll need to provide your account number, date of birth, and Social Security Number (SSN).

- Click the “Login” button, and voilà! You’re in.

Remember, keeping your login information secure is crucial. I recommend using a strong, unique password and never sharing it with anyone.

Managing Your IndigoCard Account

Once you’re logged in, a world of financial management tools is at your fingertips. Let’s explore some key features:

1. 24/7 Access

As I mentioned earlier, you can view your balance, transactions, and statements anytime. This real-time access helps you stay on top of your spending and make informed financial decisions.

2. Secure Payments

IndigoCard takes your security seriously. Their protected system ensures that your payments are processed safely, giving you peace of mind every time you pay your bill.

3. AutoPay

Setting up AutoPay is a game-changer. It ensures your monthly payments are made on time, every time. This not only saves you from the hassle of manual payments but also helps you avoid late fees, which can be as high as $40.

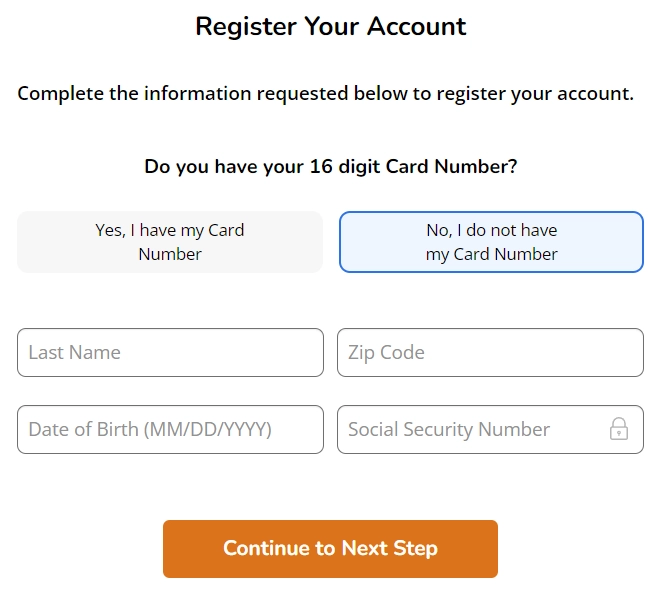

Resetting Your IndigoCard Credentials

We’ve all been there – staring at the login screen, racking our brains for that elusive username or password. But don’t worry! Resetting your IndigoCard credentials is a breeze:

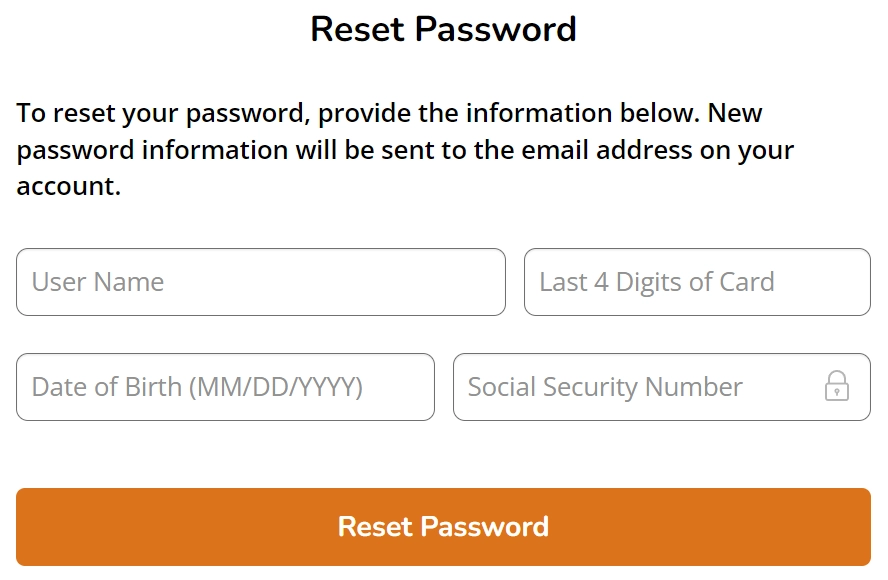

Resetting Your Password

- Go to www.indigocard.com and click on “Forgot your Username or Password?”

- Enter your username, the last four digits of your account number, your SSN, and your date of birth.

- Submit these details and follow the prompts to reset your password.

- Check your registered email for the new password information.

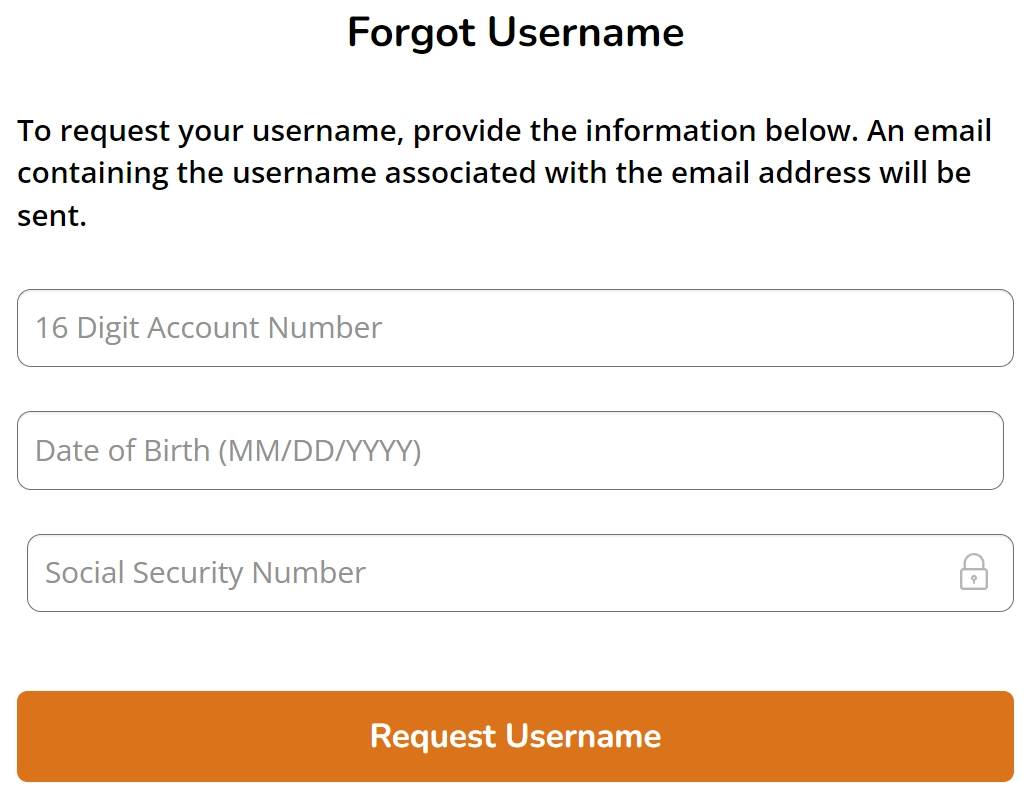

Retrieving Your Username

- On the same reset page, enter your 16-digit account number, SSN, and date of birth.

- An email with your username will be sent to your registered email address.

Remember, these security measures are in place to protect your account. Never share your personal information with anyone.

MyIndigoCard Activate ❤️【www.myindigocard.com】

Ready to activate your Indigo Credit Card? Whether you prefer the convenience of online activation or a quick phone call, getting started is a breeze.

Let’s explore the steps to unlock your card’s benefits and seamlessly manage your account.

Activation Requirements

Before diving into the activation process, gather the essentials:

- Credit Card: Have your Indigo Credit Card ready.

- Account Number: Know your card’s account number.

- Identification: Provide your date of birth and Social Security Number (SSN).

- Internet Access: Ensure a stable internet connection for online activation.

- Phone Access: For phone activation, have a device ready to call customer service.

Activation Steps

Follow these straightforward steps to activate your IndigoCard online:

- Visit the official IndigoCard activation website at www.indigocard.com.

- Click on the “Activate Card or Register” tab.

- Enter your account credentials, including your username and password.

- Input your card details as prompted.

- Assign a PIN to your IndigoCard.

- Confirm the details and click on the “Activation” button.

Once completed, a confirmation message will appear, and you’ll also receive an email confirmation regarding your Indigo Card activation.

Activate Your Indigo Card by Phone

If you prefer phone activation, simply dial 1-800-353-5920 and contact customer care. A representative will guide you through the activation process for your Indigo Card.

MyIndigoCard ❤️【Payments】

The IndigoCard offers several ways to make payments, catering to different preferences:

1. Online Payments

This is my preferred method. Simply log in to your account and use the “Bill Pay” tab. For same-day processing, make sure your payment is in before 5 pm PT.

2. Phone Payments

If you prefer a more personal touch, call 1-866-946-9545 to make a payment over the phone.

3. Mail Payments

For those who like the traditional route, send your check or money order to:

Indigo Platinum Mastercard

P.O Box 23039

Columbus GA 31902-3039

Pro tip: Always set up automatic payments. It’s an easy way to avoid late fees and keep your credit score in good shape.

MyIndigoCard ❤️【Interest Rates & Fees】

MyIndigoCard is a financial tool offering various features like credit cards, each accompanied by its unique terms, rates, and fees. Let’s delve into the specifics to grasp its nuances.

Interest Rates and Charges

For purchases and cash advances, the Annual Percentage Rate (APR) stands at 35.9%. However, if you clear your balance entirely before the due date monthly, no interest is levied on purchases. Interest accrues on cash advances from the transaction date, with a minimum interest charge of $1.00.

Fees Overview

The fee structure of MyIndigoCard encompasses setup and maintenance fees, monthly fees, and annual fees.

| Fee Type | Amount |

|---|---|

| Setup and Maintenance Fees | Varies; initial available credit reduces by around $175 |

| Monthly Fee | $0 for the first year; $150 annually thereafter |

| Annual Fee | $175 for the first year; $49 thereafter |

Additionally, transaction fees and penalty fees may apply:

- Cash Advance Fee: $5 or 5% of the transaction amount (whichever is greater), capped at $100

- Foreign Transaction Fee: 1% of each transaction in U.S. dollars

- Penalty Fees: Late Payment Fee, Overlimit Fee, Returned Payment Fee (Up to $41 each)

MyIndigoCard calculates balances using the “average daily balance (including new purchases)” method. Customers are entitled to billing rights detailed in the Cardholder Agreement.

MyIndigoCard ❤️【Card Terminology】

In the realm of credit cards, understanding the terminology is crucial for responsible financial management. Let’s delve into essential terms and concepts to navigate the credit card landscape effectively.

| Term | Definition |

|---|---|

| Annual Percentage Rate (APR) | The annualized representation of your interest rate. It encompasses various APRs, such as Purchase APR and Cash Advance APR. |

| Bankruptcy | A legal process aiding individuals and businesses in resolving debts. Common types include Chapter 7 and Chapter 13. |

| Billing Statement | A monthly record from your credit card issuer detailing transactions, balances, fees, and payment information. |

| Cash Advance | A loan from your credit card account, often accessed via ATM or bank withdrawal, with associated transaction fees. |

| Charge-Off | When a credit card balance is considered uncollectible by the issuer, often after 180 days of delinquency. |

| Credit Reporting Agencies | Companies compiling and maintaining consumer credit files, providing reports to assess creditworthiness. |

| Debt to Income Ratio | The ratio of personal debt to income, influencing credit evaluation by lenders. |

| Default | Occurs when a consumer fails to meet payment obligations, as defined by the credit card agreement. |

| Grace Period | Time allowing payment without accruing interest, mandated by the CARD Act of 2009. |

| Late Payment | Occurs when the minimum payment isn’t received by the due date, often incurring fees. |

| Minimum Payment | The lowest required monthly payment on your credit card account. |

| Returned Payment | When a payment is returned unpaid, typically resulting in fees. |

Understanding Credit Card Terms

Credit card terminology can be daunting, but grasping these terms is crucial for financial well-being. Let’s simplify and explore key concepts:

Annual Percentage Rate (APR)

The APR represents your interest rate on an annual basis. This includes various APRs, such as for purchases or cash advances.

Bankruptcy

Bankruptcy is a legal process to alleviate debts. Chapter 7 and Chapter 13 are common types for individuals and businesses.

Billing Statement

A billing statement summarizes your credit card transactions, including purchases, fees, and balances, issued monthly.

Cash Advance

A cash advance is a loan from your credit card account, often accessed through ATMs or bank withdrawals, with associated fees.

Charge-Off

Charge-off occurs when a credit card balance is deemed uncollectible by the issuer, typically after 180 days of delinquency.

Credit Reporting Agencies

Credit reporting agencies compile consumer credit information, providing reports for assessing creditworthiness.

Debt to Income Ratio

The debt-to-income ratio compares personal debt, including credit card debt, to income, influencing credit evaluations.

Default

Default occurs when a consumer fails to meet payment obligations as defined in the credit card agreement.

Grace Period

The grace period allows paying your credit card balance without accruing interest, mandated by the CARD Act of 2009.

Late Payment

Late payment incurs when the minimum payment isn’t received by the due date, often accompanied by fees.

Minimum Payment

The minimum payment is the lowest required monthly payment on your credit card account.

Returned Payment

A returned payment happens when a payment is unpaid, typically resulting in fees.

MyIndigoCard ❤️【Customer Service】

If you need to reach out to Indigo Customer Service, you can do so easily. Here are the details:

Correspondence Address:

| Concora Credit |

| PO Box 4477 |

| Beaverton, OR 97076-4477 |

Toll-Free Customer Service Number:

1-800-353-5920

Payment Address:

| Concora Credit |

| PO Box 96541 |

| Charlotte, NC 28296-0541 |

Fax Number for Indigo Mastercard

1-503-268-4711

MyIndigoCard ❤️【Frequently Asked Questions】

Can I apply over the phone?

At this time, there is no option to apply over the phone. To begin the application process, please fill out the online form. For assistance, you can reach customer service at 1-800-353-5920 (from 6:00am to 6:00pm, Pacific Time, M-F).

Can I manage my new Indigo Mastercard account online?

Absolutely! Once approved and upon receiving your new credit card, visit www.myindigocard.com to create a secure login. Your online account enables easy management of your account and bill payments.

Why was my credit card declined when I tried to use it for a foreign transaction?

For security reasons, your credit card might be declined for foreign transactions if you haven’t notified us beforehand. Call 1-800-353-5920 to set a travel alert before using your card internationally.

How can I contact Indigo Customer Service?

For any inquiries or assistance, you can reach Indigo Customer Service at: Concora Credit | PO Box 4477 Beaverton, OR | 97076-4477. Our toll-free number is 1-800-353-5920.

What are the Mastercard Benefits?

The Mastercard Benefits come with the Indigo Mastercard at no extra cost. These include Mastercard ID Theft Protection™ and Zero Liability protection. Refer to the Mastercard Guide to Benefits for detailed terms and conditions.

Will I definitely be approved?

While the credit criteria aim to assist many individuals with credit challenges, approval is not guaranteed. Each application undergoes thorough review to determine eligibility for the Indigo Mastercard.

Can I transfer a balance to my new Indigo Mastercard?

Currently, we do not offer a balance transfer option for the Indigo Mastercard.

Why should I apply for the Indigo Mastercard?

The Indigo Mastercard is an unsecured credit card that reports your account history to all major credit bureaus, aiding in building a consistent payment record and enjoying the benefits of a credit card.

How does the chip provide enhanced security?

The chip generates a unique single-use code for transaction validation at chip-enabled terminals, enhancing protection against counterfeit fraud.

How can this card help me build a good payment record?

Regular on-time monthly payments with the Indigo Mastercard demonstrate financial responsibility, contributing to a positive payment history reported to all three major credit bureaus.

Can I open more than one account?

Currently, you can only open one Indigo Mastercard account.

What if I have limited credit/bad credit/no credit?

The Indigo Mastercard is particularly suitable for those with less than perfect credit. Apply now to begin your journey towards better credit.

What if there is no chip-enabled terminal at the retailer?

If a retailer lacks chip-enabled terminals, simply swipe your card’s magnetic stripe.

Will my Indigo Mastercard offer fraud protection?

If your card is lost or stolen, contact us immediately at 1-800-304-3096. You may not be liable for unauthorized charges.

Who can apply for the Indigo Mastercard?

Individuals interested in establishing or rebuilding their credit can apply. Approval requires meeting specific criteria including age, valid social security number, address, and credit qualifications.

When will I receive my card?

In most cases, your new card arrives within 14 business days post-approval.

Why is a good payment record important?

Establishing a good payment record may enhance your eligibility for favorable rates on loans and other credit forms.

Can I use my Indigo Mastercard to get a cash advance?

Subject to credit approval, you can obtain cash advances at many financial institutions. Refer to your Cardholder Agreement for details.

Where should I send my Indigo Mastercard payment?

Send payments to Concora Credit | PO Box 96541 Charlotte, NC | 28296-0541.

What if I don’t receive my card within 14 business days?

If not received within 21 days post-approval, contact the Lost/Stolen Department at 1-800-314-6340.

What is a chip card?

A chip card contains a microchip providing enhanced security at chip-enabled terminals, reducing counterfeit fraud risks.

What are the requirements for Indigo Mastercard approval?

To qualify, you must be at least 18 years old, possess a valid social security number, address, US IP address, and meet additional credit criteria.

What are the benefits of the Indigo Mastercard?

The benefits include building credit history reported to major bureaus, aiding in mortgage and loan eligibility, and enjoying the convenience of an unsecured credit card.

Who issues the Indigo Mastercard?

The Indigo Mastercard is issued by Celtic Bank, headquartered in Salt Lake City, UT.

Can I apply for multiple Indigo Mastercard accounts?

No, you can only open one Indigo Mastercard account at present.

How can I receive a personal identification number (PIN) for my Indigo Mastercard?

Upon approval, call and request a PIN to be mailed to you. This PIN allows secure access to cash advances at ATMs.

What is the FAX number for the Indigo Mastercard?

Documents can be faxed to 1-503-268-4711.

Can I use my Indigo Mastercard for cash advances?

Subject to credit approval, you can obtain cash advances at various financial institutions. Refer to your Cardholder Agreement for details.

How does the chip card work?

At chip-enabled terminals, insert your card into the slot, follow on-screen instructions, and remove upon completion. For non-chip terminals, swipe your card.

How can I contact Indigo Customer Service?

For inquiries, reach us at Concora Credit | PO Box 4477 Beaverton, OR | 97076-4477. Customer service: 1-800-353-5920.